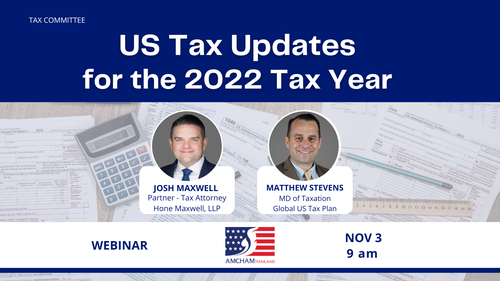

Tax Committee: US Tax Updates for the 2022 Tax Year

Date and Time

Thursday Nov 3, 2022

9:00 AM - 10:00 AM ICT

Location

Online Webinar

Fees/Admission

Members: Free of charge

Non-members: 1,000 baht

Description

In the aftermath of the Covid-19 pandemic, there has been no reduction in filing or disclosure requirements for US persons doing business in Thailand, nor for Thai persons doing business in the US. With recent legislative and judicial actions, it is important for all US persons with foreign-sourced income and assets, and for Thai persons with US-sourced income and assets, to be informed about their obligations to the US Treasury.

In our end-of-year tax update, the AMCHAM Tax Committee would like to welcome you to discuss topics that impact US taxpayers worldwide. The topics of discussion will include, but are not limited to, the following:

- The Inflation Reduction Act

- The Corporate Transparency Act

- Updates on FATCA Reporting

- Court cases that could affect US persons with non-US assets.